Customer Claim Experience Platform Enhancing Service

Customer Claim Experience Platform sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

In today’s fast-paced world, the efficiency and effectiveness of customer service are paramount, and the Customer Claim Experience Platform emerges as a crucial tool in this landscape. These platforms streamline the claim handling process, ensuring that customers receive timely and satisfactory resolutions. With the evolution of technology, these platforms have transformed the way businesses interact with their clients, making them an essential component across various industries.

Introduction to Customer Claim Experience Platforms

Customer Claim Experience Platforms are sophisticated systems designed to streamline the process of managing and resolving customer claims. These platforms provide an integrated solution that allows companies to efficiently handle customer inquiries, track claims, and ensure timely resolutions, ultimately enhancing the overall customer experience. As businesses increasingly prioritize customer satisfaction, having a dedicated system for claim management has become a crucial component of effective customer service.In today’s fast-paced market, the importance of Customer Claim Experience Platforms cannot be overstated.

With the rise of digital communication and the expectation for instant responses, businesses must adapt their claim handling processes to meet these new demands. These platforms not only facilitate quicker resolutions but also enable organizations to maintain transparency and build trust with their customers. The evolution of claim handling has seen a significant shift from traditional, manual processes to automated, technology-driven solutions, which has proven to enhance efficiency and customer satisfaction across various industries.

Evolution of Claim Handling in Various Industries, Customer Claim Experience Platform

The transformation of claim handling practices across different sectors has been driven by technological advancements, changing customer expectations, and the need for regulatory compliance. This evolution can be characterized by several key developments:

- Advent of Digital Solutions: The introduction of web-based platforms has allowed customers to submit claims online, reducing wait times and improving accessibility.

- Integration of AI and Machine Learning: Automated systems can analyze claims and predict outcomes, enabling faster decision-making and resource allocation.

- Enhanced Customer Communication: Real-time updates and transparent tracking of the claim process through mobile apps and notifications have increased customer engagement and satisfaction.

- Data Analytics Utilization: Companies now leverage data analytics to identify trends, improve processes, and tailor services to meet customer needs effectively.

These advancements have directly contributed to a more efficient claim handling process, with businesses being able to resolve claims in a fraction of the time it previously took. The move towards a customer-centric approach has helped industries such as insurance, retail, and healthcare to not only meet customers’ needs but also create a competitive advantage in their respective markets.

“The evolution of claim handling has shifted the paradigm, making customer satisfaction central to business strategies.”

In summary, Customer Claim Experience Platforms represent a vital evolution in customer service, addressing the need for speed, efficiency, and transparency in claim resolution. As these systems continue to evolve, businesses will be better equipped to meet the demands of their customers, ensuring loyalty and long-term success.

Key Features of Customer Claim Experience Platforms

Customer Claim Experience Platforms are designed to streamline the claims process and improve customer satisfaction. These platforms integrate various tools and technologies to create an efficient, user-friendly experience for both customers and claims handlers. By understanding the key features of these platforms, businesses can make informed decisions about which solution best fits their needs.An effective Customer Claim Experience Platform typically includes several essential features that enhance overall performance and customer interaction.

Technological advancements in this space, such as artificial intelligence (AI) and machine learning, play a significant role in transforming traditional claim processes into seamless digital experiences. Below are critical features that make these platforms effective.

Essential Features of Customer Claim Experience Platforms

The following features are vital for delivering an optimal customer claim experience:

- Intuitive User Interface: A clean and straightforward interface allows customers to navigate the platform easily, reducing confusion and frustration during the claims process.

- Automated Claim Processing: Automation tools speed up the claims lifecycle by reducing manual intervention, allowing for quicker assessment and approval of claims.

- Real-time Tracking: Customers benefit from real-time updates on the status of their claims, fostering trust and transparency between them and the insurer.

- Integration Capabilities: Seamless integration with existing systems, such as CRM or ERP, ensures a holistic view of customer data and a smoother workflow across departments.

- Data Analytics and Reporting: Advanced analytics tools help identify trends, uncover insights, and generate reports that inform decision-making and improve service delivery.

Technological advancements further enhance the capabilities of Customer Claim Experience Platforms. These innovations not only optimize the claims process but also elevate customer satisfaction.

Technological Advancements Enhancing Customer Experience

Today’s platforms are equipped with cutting-edge technologies that redefine customer interaction in claims management:

- Artificial Intelligence: AI algorithms can analyze claims data to detect fraud, predict outcomes, and assist in decision-making, leading to quicker resolutions.

- Chatbots and Virtual Assistants: These tools provide 24/7 customer support, answering queries instantly and guiding users through the claims process without human intervention.

- Mobile Accessibility: Mobile-responsive designs and dedicated apps allow customers to file and track claims on their smartphones, catering to a tech-savvy audience.

- Blockchain Technology: By ensuring data integrity and transparency, blockchain can enhance trust in the claims process through secure transactions and verifiable records.

- Cloud Computing: Cloud-based platforms facilitate easy access to data and applications from anywhere, improving collaboration and scalability for businesses.

When comparing various Customer Claim Experience Platforms, unique functionalities can set one platform apart from another.

Comparison of Platforms Based on Unique Functionalities

Understanding the differentiating features of various platforms allows businesses to choose the most suitable one for their needs. Here are notable functionalities that various platforms offer:

- Customizable Workflows: Some platforms allow businesses to tailor workflows based on specific needs, enhancing operational efficiency.

- Multi-channel Support: Integration across various communication channels—such as email, chat, and phone—ensures comprehensive customer support.

- Self-service Portals: Enabling customers to manage their claims independently through user-friendly portals can significantly reduce the workload on customer service teams.

- Enhanced Security Features: Robust security measures, including encryption and multi-factor authentication, protect sensitive customer information and build trust.

- Comprehensive Training and Support: Some platforms provide extensive training resources and ongoing support, ensuring customers can utilize all available features effectively.

By focusing on these key features and advancements, businesses can select a Customer Claim Experience Platform that not only meets their operational needs but also elevates customer satisfaction and loyalty.

Benefits of Implementing a Customer Claim Experience Platform

![The Marketing Mix | Introduction to Business [Deprecated] Customer Claim Experience Platform](https://ep.investekno.biz.id/wp-content/uploads/2025/11/customer-service.jpg)

Source: thebluediamondgallery.com

Implementing a Customer Claim Experience Platform can significantly enhance the way businesses interact with their clients during the claims process. These platforms are designed to streamline operations, improve communication, and ultimately lead to greater customer satisfaction. When customers feel supported and understood throughout their claims journey, their loyalty to the brand increases, paving the way for long-term business success.One of the most vital aspects of a Customer Claim Experience Platform is its ability to improve customer satisfaction.

By offering a user-friendly interface and simplifying the claims process, these platforms allow customers to submit and track claims effortlessly. A more intuitive experience reduces frustration and encourages positive engagements.

Metrics Demonstrating Value

To assess the effectiveness of Customer Claim Experience Platforms, various metrics can be utilized. These metrics provide insight into customer interactions and operational performance, showcasing the tangible benefits of adopting such technology.For instance, businesses often observe:

- Increased Net Promoter Score (NPS): Companies using these platforms often report a significant rise in their NPS, indicating that customers are more likely to recommend their services.

- Shorter Claims Processing Time: With automation and streamlined workflows, the time taken to process claims can decrease by 30% to 50%, enhancing customer satisfaction.

- Higher Claim Resolution Rates: Many platforms result in a resolution rate increase of 20% or more, indicating more effective handling of customer claims.

The implementation of these metrics not only highlights customer satisfaction improvements but also indicates a more efficient operational model.

Impact on Operational Efficiency and Cost Savings

The adoption of a Customer Claim Experience Platform leads to notable enhancements in operational efficiency and significant cost savings for organizations. By automating routine tasks and providing real-time data access, these platforms help businesses streamline their claims processes.Key impacts include:

- Reduced Manual Work: Automation minimizes the need for manual entry and repetitive tasks, cutting down on labor costs and reducing human error.

- Efficient Resource Allocation: Employees can focus on more complex issues rather than mundane tasks, optimizing workforce productivity.

- Lower Operational Costs: By decreasing the average cost per claim through automation and efficiency, companies can save substantial amounts annually—potentially millions depending on their size and claim volume.

These benefits illustrate how Customer Claim Experience Platforms not only enhance customer satisfaction but also drive operational excellence and financial advantages for businesses.

Integration with Existing Systems

Integrating a Customer Claim Experience Platform with existing IT infrastructure is crucial for a seamless transition and optimal functionality. This integration not only enhances efficiency but also ensures that all systems work harmoniously together. By connecting the new platform with current systems such as CRM, ERP, and databases, organizations can streamline their claim processes and improve the overall customer experience.The integration process can vary depending on the specific systems involved and the technologies used.

Common methods for integration include API connections, middleware solutions, and direct database links. Each method has its own advantages and can be selected based on the organization’s needs and existing infrastructure.

Integration Process Steps

To achieve a successful integration, follow these key steps that Artikel the process clearly:

1. Assessment of Current Systems

Evaluate the existing IT landscape, including software applications, databases, and data flow. Identify potential integration points and data exchange requirements.

2. Selection of Integration Method

Choose the most suitable integration method. API connections are popular for real-time data exchange, while middleware may facilitate more complex integrations.

3. Data Mapping

Define how data will be transferred between systems. Ensure that all necessary data points align correctly to prevent loss or miscommunication of information.

4. Development of Integration

Begin the development phase where the integration is built based on the chosen method. This may involve coding APIs, configuring middleware, or setting up direct connections.

5. Testing the Integration

Conduct thorough testing to ensure data flows correctly between systems without errors. This phase is crucial for identifying potential issues before going live.

6. Implementation and Monitoring

Roll out the integration in a controlled manner. Monitor performance closely for any discrepancies and be ready to make adjustments as needed.

Challenges and Solutions During Integration

Integrating a new platform can present various challenges, but understanding these potential obstacles allows organizations to prepare and implement effective solutions.One common challenge is data compatibility. Different systems may use varying data formats or structures, which can lead to integration issues. The solution is to conduct comprehensive data mapping and transformation strategies to ensure consistency.Another challenge can be resistance from users.

Employees may be accustomed to existing systems and hesitant to adapt to new processes. Implementing robust training programs and clearly communicating the benefits of the new platform can help ease this transition.Furthermore, issues related to system downtime during integration can disrupt daily operations. Planning the integration for off-peak hours and having a rollback plan in place can mitigate this risk.By navigating these challenges with proactive strategies, organizations can ensure a smoother transition to a Customer Claim Experience Platform that enhances operational efficiency and customer satisfaction.

Case Studies of Successful Implementation

Adopting a Customer Claim Experience Platform has proven to be transformative for various companies across industries. These platforms not only streamline the claims process but also enhance customer satisfaction and operational efficiency. Here, we delve into some detailed examples of businesses that have successfully implemented these platforms, highlighting their strategies and the outcomes achieved.

Insurance Company Transformation

One noteworthy case is a mid-sized insurance company that faced significant challenges in managing customer claims. The company implemented a Customer Claim Experience Platform to replace their outdated manual processes. The strategy involved comprehensive training for staff on the new system, coupled with a robust communication plan to keep customers informed throughout the claims process. The outcomes were remarkable:

- Claim processing time was reduced by 40%, allowing for quicker resolutions and improved customer satisfaction.

- Customer feedback scores increased by 30%, reflecting the enhanced user experience.

- Operational costs were reduced by 25% due to decreased labor and resource allocation for claim handling.

“The new platform has turned our claims process from a headache into a seamless experience, both for our customers and our staff.”

Claims Manager

Retail Sector Improvement

A national retail chain adopted a Customer Claim Experience Platform to manage product return claims more efficiently. The strategy focused on integrating the platform with their existing e-commerce and inventory systems, allowing for real-time updates on product availability and return status. Key outcomes from this implementation included:

- Return claim resolution time decreased by 50%, significantly improving customer retention rates.

- The percentage of claims escalated to customer service dropped by 60% as the platform allowed for self-service options.

- Sales increased by 15% as customer trust grew due to efficient handling of claims.

“With the new platform, our customers feel empowered to manage their returns with ease, which drives their loyalty.”

Customer Service Director

Lessons Learned from Implementation

From these case studies, several key lessons emerged for organizations considering adopting a Customer Claim Experience Platform:

1. Training is Crucial

Effective training for both staff and customers is essential for ensuring smooth transitions and maximizing the benefits of the new platform.

2. Integration Matters

Seamless integration with existing systems can amplify the efficiency and effectiveness of the claims process.

3. Customer Communication

Keeping customers informed throughout the claims lifecycle enhances satisfaction and reduces frustration.

4. Feedback is Valuable

Regularly collecting and analyzing customer feedback can help in refining the claims process and addressing any recurring issues.These case studies illustrate that with the right strategies in place, adopting a Customer Claim Experience Platform can lead to significant improvements in both customer satisfaction and organizational efficiency.

Future Trends in Customer Claim Experience Platforms

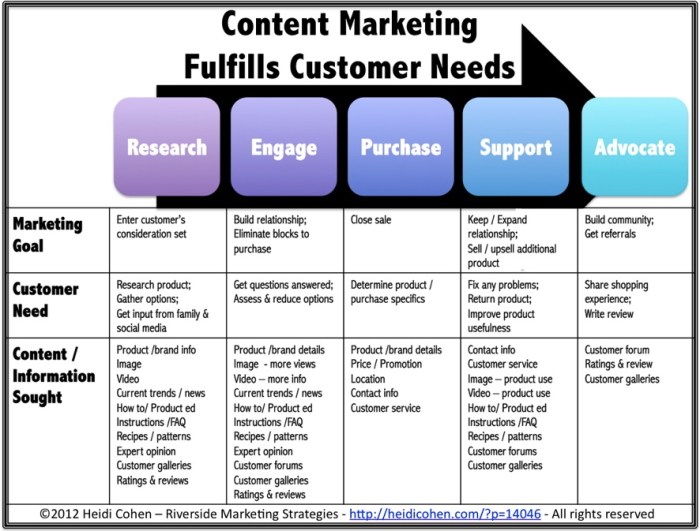

Source: heidicohen.com

As technology continues to evolve, the landscape of Customer Claim Experience Platforms is set to undergo significant transformation. Businesses are increasingly leveraging innovative technologies to enhance the customer experience and streamline claim processing. The demands of modern consumers are changing, and these platforms must adapt to meet these new expectations while navigating upcoming regulatory challenges.Emerging technologies play a pivotal role in shaping the future of Customer Claim Experience Platforms.

Artificial intelligence (AI) and machine learning (ML) are at the forefront, enabling platforms to automate routine tasks, analyze large datasets, and provide predictive insights into claim outcomes. Blockchain technology is also gaining traction, offering improved transparency and security in transactions, which can instill greater trust among customers. Additionally, the incorporation of chatbots powered by AI can facilitate real-time customer support, ensuring that queries and claims are addressed promptly.

Anticipated Changes in Customer Expectations

Consumers are becoming more informed and demanding when it comes to their interactions with businesses. They expect seamless experiences, quick resolutions, and personalized service. To keep pace with these expectations, Customer Claim Experience Platforms must prioritize user experience and accessibility. The following factors are anticipated to influence customer expectations:

- Instant Gratification: Customers now expect immediate responses and swift claim processing times. Platforms should incorporate automation tools to minimize waiting periods.

- Personalization: Tailored interactions based on customer history and preferences can significantly enhance satisfaction. Utilizing data analytics to provide a customized experience is essential.

- Multi-Channel Support: Customers want to reach out through various channels, including social media, mobile apps, and traditional methods. A unified approach that integrates these channels can enhance customer engagement.

Potential Regulatory Impacts on Claim Processing

The regulatory environment surrounding claim processing is evolving, and it is important for platforms to stay ahead of compliance requirements. Increased regulations aimed at protecting consumer data and promoting transparency are likely to shape the future of Customer Claim Experience Platforms. Key considerations include:

- Data Protection Laws: With regulations like GDPR and CCPA gaining prominence, platforms must ensure that customer data is handled with the utmost care and security.

- Transparency Requirements: Regulatory bodies may impose stricter guidelines regarding the clarity of communication concerning claim processes. Platforms should adopt clear protocols to ensure compliance and maintain customer trust.

- Fair Processing Practices: The need for fair treatment in claims processing may lead to more robust auditing standards to prevent bias and ensure equitable services.

Investing in technology and adapting to changing regulatory landscapes are crucial for enhancing customer satisfaction and operational efficiency in the realm of claims processing.

Best Practices for Maximizing the Effectiveness of a Platform

Maximizing the effectiveness of a Customer Claim Experience Platform requires a strategic approach that focuses on best practices, staff training, and a framework for continuous improvement. Implementing these practices ensures that organizations fully leverage the capabilities of the platform to enhance customer satisfaction and operational efficiency.

Checklist of Best Practices for Users

To ensure that users can effectively utilize the Customer Claim Experience Platform, it is essential to follow a structured checklist of best practices. This checklist can guide teams in their day-to-day operations, ensuring that they harness the full potential of the platform.

- Regularly update user profiles to maintain accurate information.

- Utilize automated workflows to streamline claim processing.

- Monitor and analyze claim trends to identify common issues.

- Encourage real-time communication among team members for faster resolution.

- Leverage data analytics to guide decision-making and policy adjustments.

- Ensure that all claims are documented systematically for easy reference and review.

- Implement a ticketing system for tracking claims and follow-ups.

Importance of Training for Staff Members

Training is pivotal in ensuring that staff members can effectively navigate and utilize the Customer Claim Experience Platform. A well-trained team can significantly improve workflows, reduce errors, and enhance customer interactions. Providing comprehensive training programs helps staff understand the platform’s features, functionalities, and best practices. Regular training sessions that cover updates and new features can keep the team informed and engaged.

It is beneficial to incorporate hands-on training and simulations to build familiarity in real-world scenarios.

“An informed team is empowered to deliver exceptional service, leading to enhanced customer satisfaction.”

Framework for Continuous Improvement and Feedback Collection

Establishing a framework for continuous improvement is essential for maximizing the effectiveness of the Customer Claim Experience Platform. This framework should focus on regular feedback collection and the iterative enhancement of processes.Organizations can implement feedback mechanisms such as surveys and focus groups to gather insights from both staff and customers. Analyzing this feedback allows for the identification of pain points and areas for improvement.

Documentation of all feedback and subsequent adjustments can create a comprehensive overview of changes made over time, fostering a culture of continuous improvement. Regular review meetings can be scheduled to assess the platform’s performance and implement necessary changes, ensuring the platform evolves in line with user needs and industry trends.

Customer Feedback and Improvement Mechanisms: Customer Claim Experience Platform

Collecting customer feedback is crucial for refining and enhancing the Customer Claim Experience Platform. By establishing robust feedback mechanisms, companies can gain valuable insights into customer satisfaction, pain points, and areas that require improvement. This ensures that customer voices are heard and taken into account, leading to a more user-centric platform.Effective feedback collection methods play a pivotal role in understanding customer experiences.

Utilizing a combination of qualitative and quantitative approaches can yield comprehensive insights. Commonly employed methods include:

Feedback Collection Methods

The following methods are essential for gathering customer feedback effectively:

- Surveys: Online surveys can be sent post-claim resolution to gauge customer satisfaction and gather specific insights on their experiences.

- Feedback Forms: Integrating feedback forms directly within the platform allows customers to share their thoughts at any stage of their journey.

- Focus Groups: Organizing focus groups with customers can provide deeper insights into their experiences and expectations from the platform.

- Net Promoter Score (NPS): This metric helps organizations understand customer loyalty and likelihood to recommend the platform to others.

- Social Media Monitoring: Analyzing customer comments and feedback on social media provides real-time insights into customer sentiment and satisfaction.

Incorporating feedback into system enhancements is vital for continuous improvement. Organizations should establish a systematic process to analyze, prioritize, and implement changes based on customer input.

Incorporating Feedback into System Enhancements

To ensure customer feedback translates into tangible improvements, consider the following approaches:

- Feedback Analysis: Regularly analyze collected feedback to identify trends and recurring issues. This can be done using data analytics tools to categorize and quantify feedback.

- Action Plans: Develop clear action plans outlining how feedback will be addressed, including timelines and responsible teams.

- Iterative Development: Adopt an agile development approach that allows for quick iterations based on customer feedback. This ensures that improvements can be made promptly.

- Customer Involvement: Involve customers in the improvement process by seeking their opinions on proposed changes through beta testing or follow-up surveys.

Measuring the success of improvements made based on customer input is essential for validating the effectiveness of changes and ensuring ongoing customer satisfaction.

Measuring the Success of Improvements

Organizations should implement metrics to assess the impact of enhancements driven by customer feedback. Key performance indicators (KPIs) to monitor include:

- Customer Satisfaction Score (CSAT): This score reflects customer satisfaction levels post-implementation of changes.

- Reduction in Complaint Volume: Monitoring the number of complaints or issues raised can indicate whether changes have effectively addressed customer concerns.

- Increased NPS: A rise in NPS after implementing changes can demonstrate enhanced customer loyalty and satisfaction.

- Engagement Metrics: Track user engagement levels within the platform, looking for increased interaction with features that were enhanced based on feedback.

“Regularly measuring customer feedback not only validates the effectiveness of improvements but also fosters an ongoing dialogue with customers, reinforcing their value to the organization.”

Security and Compliance Considerations

The security and compliance framework of a Customer Claim Experience Platform is essential to safeguard sensitive customer data and maintain trust. As digital transformations accelerate, organizations must ensure that their platforms meet security standards while complying with industry regulations. This section delves into the necessary security measures and compliance requirements that companies should adhere to when implementing these platforms.

Security Measures for Customer Claim Experience Platforms

Implementing comprehensive security measures is vital for protecting customer data from breaches and unauthorized access. Key security measures include:

- Data Encryption: Encrypting data both in transit and at rest is crucial for ensuring that customer information remains confidential. This means using protocols such as HTTPS for data transmission and strong encryption algorithms for stored data.

- Access Controls: Establishing strict access controls helps limit who can view or modify sensitive information. Role-based access control (RBAC) ensures that users only have access to the information necessary for their roles.

- Regular Security Audits: Conducting periodic security audits identifies vulnerabilities and ensures compliance with established security protocols. These audits should assess the effectiveness of existing security measures and recommend improvements.

- Incident Response Plan: Developing a robust incident response plan prepares organizations for potential security breaches. This plan should Artikel immediate actions, communication strategies, and recovery procedures to minimize damage.

Importance of Compliance with Industry Regulations

Compliance with industry regulations, such as GDPR, HIPAA, and PCI-DSS, is not just a legal obligation but also a crucial aspect of building customer trust. Regulatory compliance ensures that organizations handle customer claims with the utmost care, protecting their rights and personal information. Industry regulations often stipulate specific requirements for data handling, breach notifications, and record-keeping, which are essential for maintaining the integrity of customer interactions.

Guide for Conducting Security Assessments and Audits

To ensure ongoing security and compliance, organizations should conduct regular security assessments and audits. Here is a step-by-step guide to facilitate this process:

- Define Security Objectives: Clearly Artikel the security objectives based on regulatory requirements and organizational policies. This helps in tailoring assessments to specific needs.

- Identify Assets and Vulnerabilities: Catalogue all digital assets associated with the Customer Claim Experience Platform and identify potential vulnerabilities through penetration testing and vulnerability scanning.

- Evaluate Security Controls: Assess the effectiveness of existing security controls. This involves examining access controls, encryption methods, and incident response plans.

- Conduct Risk Assessments: Analyze the risk associated with identified vulnerabilities and prioritize remediation efforts based on potential impact and likelihood of occurrence.

- Document Findings: Maintain thorough documentation of the assessment process, including identified vulnerabilities, recommended actions, and timelines for remediation.

- Implement Improvements: Based on the audit findings, implement necessary security improvements and establish a timeline for re-evaluation to ensure continuous compliance.

Conclusion and Next Steps for Implementation

Implementing a Customer Claim Experience Platform is a strategic move that can significantly enhance how organizations manage claims while improving customer satisfaction. Throughout the discussion, we explored the various aspects of these platforms, including their key features, benefits, integration capabilities, and future trends that shape their evolution. The insights shared illustrate how essential it is for businesses to adopt such platforms to stay competitive in today’s customer-centric landscape.For organizations considering the implementation of a Customer Claim Experience Platform, there are several actionable steps to take.

Emphasizing a structured approach ensures a smoother transition and maximizes the potential benefits.

Actionable Steps for Implementation

Initiating the adoption of a Customer Claim Experience Platform requires thoughtful planning and execution. The following steps provide a clear roadmap for organizations looking to implement such a system:

- Conduct a Needs Assessment: Identify the specific needs of your organization and customers that the platform should address. This involves gathering feedback from stakeholders and evaluating existing processes.

- Research and Select the Right Platform: Explore various platforms available in the market, considering their features, scalability, integration capabilities, and user reviews to find the most suitable option.

- Develop a Project Plan: Create a detailed project plan outlining timelines, responsibilities, and resources needed for successful implementation. This should also include training for staff and change management strategies.

- Integrate with Existing Systems: Ensure the platform can seamlessly integrate with your current systems, such as CRM or ERP, to facilitate data flow and maintain operational continuity.

- Test and Optimize: Conduct thorough testing of the platform before full deployment. Gather data on usability and performance to refine the system based on user experience.

- Launch and Train: Officially launch the platform and provide comprehensive training for all users to ensure proficiency and confidence in using the new system.

- Monitor and Improve: After implementation, continuously monitor the platform’s performance and gather user feedback to make necessary adjustments and improvements.

For further reading and exploration in the area of Customer Claim Experience Platforms, consider the following resources:

- Industry Reports on Customer Experience Trends and Technologies

- Webinars and Workshops by Leading Customer Experience Experts

- Case Studies from Organizations that Have Successfully Implemented Claim Experience Platforms

- Books on Customer Experience Management and Digital Transformation

- Online Forums and Communities for Peer Support and Knowledge Sharing

By adhering to these steps and utilizing available resources, organizations can effectively implement a Customer Claim Experience Platform that not only meets their operational needs but also enhances customer satisfaction and loyalty.

Conclusion

Source: picpedia.org

As we delve into the transformative potential of the Customer Claim Experience Platform, it’s evident that organizations embracing these solutions stand to gain significantly in customer satisfaction and operational efficiency. By understanding the key features, benefits, and best practices, businesses can navigate the complexities of claim processing and elevate their overall service quality. Embracing these platforms not only meets current customer expectations but also prepares organizations for future challenges.

User Queries

What is a Customer Claim Experience Platform?

It is a specialized system designed to streamline and enhance the process of handling customer claims efficiently.

How does a Customer Claim Experience Platform improve customer satisfaction?

By providing quicker responses, easier claim submission processes, and effective resolution tracking, it enhances the overall customer experience.

Can these platforms integrate with existing IT systems?

Yes, most Customer Claim Experience Platforms are designed to seamlessly integrate with current IT infrastructures, enhancing their usability.

What metrics can demonstrate the value of these platforms?

Key metrics include reduced claim processing times, increased customer satisfaction scores, and improved operational efficiency.

Are there security measures necessary for these platforms?

Yes, robust security measures are essential to protect sensitive customer data and ensure compliance with industry regulations.