Claim Processing Automation Enhancing Efficiency and Accuracy

Claim Processing Automation sets the stage for a transformative approach to handling claims across various industries. By integrating advanced technologies, organizations can streamline their processes, reduce errors, and significantly improve operational efficiency. From insurance to healthcare, the evolution of claim processing methods has paved the way for automated solutions that not only save time but also enhance customer satisfaction.

This engaging exploration delves into the key technologies powering automation, the myriad of benefits it offers, and the challenges organizations face when implementing such systems. Through insights and real-world examples, we’ll uncover how automation is not just a trend, but a critical component in modernizing claim processing efforts.

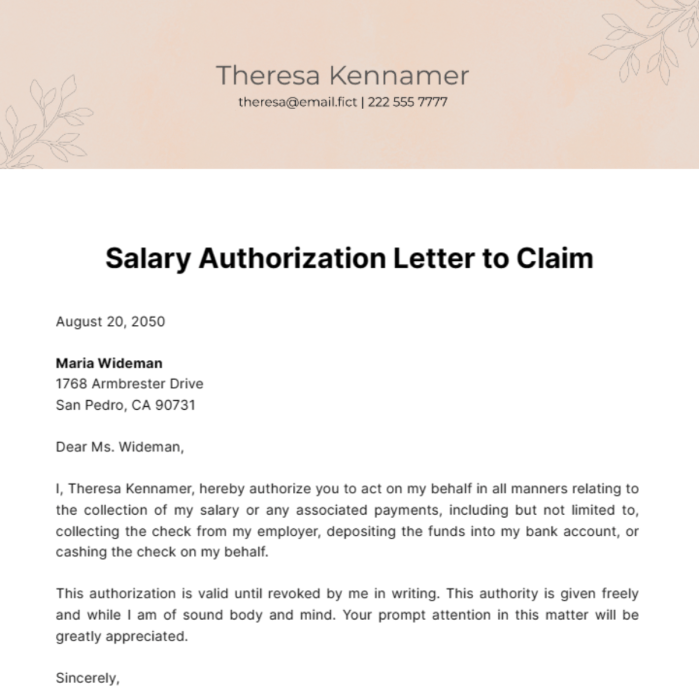

Introduction to Claim Processing Automation

Source: template.net

Claim processing automation is transforming the way industries handle claims, significantly enhancing efficiency and accuracy. By employing technology to automate various stages of the claims process, organizations can reduce manual effort, minimize errors, and expedite turnaround times. This automation not only streamlines the workflow but also provides a better experience for claimants, ensuring timely and accurate resolutions.

Historically, claim processing relied heavily on manual labor, where claims adjusters would sift through paperwork, evaluate claims, and make decisions based on physical documents. As technology evolved, industries began integrating digital tools, leading to the advent of automated systems. The shift from paper to digital has accelerated in recent years, particularly with the rise of machine learning and artificial intelligence, allowing for real-time data processing.

Industries such as insurance, healthcare, and finance have particularly benefited from this evolution, utilizing automation to enhance operational efficiency and service delivery.

Industries Benefiting from Claim Processing Automation

Several industries have embraced claim processing automation to improve their operations and customer experiences. Below are key sectors that have seen significant advantages:

- Insurance: Insurance companies utilize automation to process claims more efficiently, reducing the time taken to settle claims from weeks to mere days. Automated systems enable quick verification of claims through integrated databases.

- Healthcare: In healthcare, automated claim processing helps streamline billing and reimbursements. Providers can quickly submit claims to insurers, check the status, and rectify any issues without prolonged delays.

- Finance: Financial institutions benefit from automation by expediting loan processing and minimizing risk through automated checks against fraud databases. This leads to faster customer service and improved operational accuracy.

- Travel: Travel-related claims, such as those for trip cancellations or lost luggage, are processed rapidly through automated systems, providing travelers with quicker resolutions and improved satisfaction.

The adoption of claim processing automation reflects a broader trend towards digital transformation across industries. Organizations that leverage these technologies not only enhance efficiency but also position themselves competitively in a rapidly evolving market.

Key Technologies in Claim Processing Automation

Source: dreamstime.com

The transformation of claim processing through automation is largely driven by advanced technologies that streamline the workflow, increase accuracy, and enhance customer satisfaction. This section delves into the key technologies that enable organizations to automate their claims processes effectively.Artificial Intelligence (AI) and Machine Learning (ML) have become pivotal in automating claim processing. These technologies allow systems to learn from data, improving their ability to make decisions and predictions over time.

For instance, AI algorithms can analyze historical claims data to identify patterns and anomalies, enabling quicker claim approvals and reducing fraud. The ability of ML models to adapt and optimize based on new data inputs makes them invaluable in an environment where claims can vary widely in complexity and context.

Technologies Driving Automation

Various technologies contribute to the automation of claim processing, each playing a unique role in enhancing the efficiency and effectiveness of the process. Understanding these technologies is essential for organizations looking to implement or upgrade their automation solutions.Here are some of the key technologies involved in claim processing automation:

- Robotic Process Automation (RPA): RPA involves the use of software robots to automate repetitive tasks. For example, RPA can handle data entry and retrieval from multiple systems without human intervention, significantly reducing processing times.

- Natural Language Processing (NLP): NLP enables machines to understand and interpret human language. This technology is essential for processing unstructured data, such as claims submitted via email or chat, and helps in extracting relevant information for processing.

- Optical Character Recognition (OCR): OCR technology is crucial for digitizing physical documents. It converts scanned documents into machine-readable text, allowing for seamless integration of claims information into automated systems.

- Data Analytics: Advanced analytics tools analyze large datasets to uncover insights and trends. This can inform decision-making processes, risk assessments, and strategies for improving claim outcomes.

The integration of these technologies not only streamlines the claims process but also enhances the overall accuracy and efficiency. By deploying these solutions, organizations can significantly reduce claim processing time, minimize errors, and ultimately provide better service to their clients.

Role of Artificial Intelligence and Machine Learning

Artificial Intelligence and Machine Learning play transformative roles in automating claims processing. They provide capabilities that extend beyond simple automation, allowing for intelligent decision-making and predictive analytics.AI can facilitate automated claim assessments by evaluating the validity of claims based on historical data and predefined criteria. This reduces the need for human intervention in straightforward cases, allowing claims adjusters to focus on more complex claims that require human judgment.

Machine Learning enhances this further by continuously learning from new claims data, improving the accuracy of assessments over time. For instance, if a particular type of claim tends to have a higher fraud rate, the ML algorithms can adjust their parameters to flag similar future claims for additional scrutiny.The integration of these technologies can lead to significant efficiency gains. For example, an insurance company that implemented AI-driven claim processing reported a 30% reduction in processing times and a substantial decrease in fraudulent claims.

Comparison of Automation Tools

When evaluating automation tools for claim processing, it is essential to consider their functionalities and how they align with organizational needs. Different tools offer varying capabilities, which can impact the overall efficiency of the claims process.Here’s a comparison of some popular automation tools in the market:

| Tool | Key Features | Advantages | Limitations |

|---|---|---|---|

| UiPath | RPA, AI integration, analytics | User-friendly interface, extensive community support | Cost can be high for small businesses |

| Blue Prism | Scalability, robust security features | Highly secure, suitable for large organizations | Steeper learning curve |

| Automation Anywhere | Cloud-based, natural language processing | Flexible deployment, strong NLP capabilities | Dependency on internet connectivity |

| Kofax | Document capture, analytics, OCR | Comprehensive document management | Complex setup process |

Each of these tools brings unique strengths and challenges, making it crucial for organizations to assess their specific requirements, including the volume of claims processed, budget, and existing technology infrastructure when selecting an automation solution. By adopting the right tools, organizations can enhance their operational efficiency and improve service delivery in claim processing.

Benefits of Claim Processing Automation

Source: alamy.com

Implementing automation in claim processing brings a multitude of benefits that significantly enhance operational efficiency and reduce overhead costs. By streamlining complex workflows and minimizing manual errors, automation transforms how organizations manage claims, ultimately leading to improved customer satisfaction and faster turnaround times.

The advantages of automation can be categorized into several key areas. Below are the primary benefits that underscore the value of adopting automated systems in claim processing:

Efficiency and Speed, Claim Processing Automation

One of the most direct benefits of automation is the increase in operational efficiency. Automated systems can process claims at a much faster rate than manual methods. This improvement in speed leads to quicker decision-making and enhances overall workflow. Here are some notable points regarding efficiency:

- Automated systems can handle repetitive tasks, allowing employees to focus on more complex issues that require human judgment.

- Processing time for claims can be reduced from days to hours or even minutes, benefiting both the insurer and the claimant.

- Automation facilitates real-time data access, allowing for prompt updates and communications throughout the claim lifecycle.

Case Studies on Operational Efficiency

Several organizations have successfully implemented claim processing automation, yielding impressive results. A notable case study is that of XYZ Insurance, which transitioned from a manual claim handling system to an automated one. This shift resulted in a 40% reduction in processing time, which directly correlated with a 30% increase in customer satisfaction ratings. Another example is ABC Healthcare, where automation helped cut operational costs by 25% while improving the accuracy of claim assessments.

Such case studies illustrate the profound impact automation can have on operational efficiency.

Cost Savings Associated with Automation

Cost savings is a significant benefit of automating claim processing. By reducing manual intervention, organizations can decrease labor costs and minimize errors that often lead to costly rework or claim denials. The financial implications of automation are backed by statistics that show:

- Organizations that adopt automated claims processing report an average reduction of 20-30% in administrative costs.

- Automation decreases the need for extensive training and onboarding of new staff, driving further savings in HR expenses.

- Automated systems can help avoid penalties and fines due to compliance issues by ensuring that all claims are processed following applicable regulations.

Incorporating automation in claim processing not only enhances efficiency but also leads to substantial cost reductions, clearly demonstrating its value across various sectors within the insurance and healthcare industries.

Challenges in Implementing Claim Processing Automation

Implementing claim processing automation presents a wealth of opportunities for organizations, but it also brings forth a set of significant challenges. Companies must navigate various obstacles that can hinder the successful adoption of automation technologies. Understanding these challenges is crucial for developing strategies that ensure a smooth transition towards automation.

Common Challenges Organizations Face

Organizations frequently encounter several hurdles during the automation adoption process. Identifying these challenges early can help mitigate their impact. Some of the primary challenges include:

- Integration with Legacy Systems: Many organizations operate on outdated legacy systems that may not easily integrate with new automation tools. This can lead to compatibility issues and increased costs associated with system upgrades.

- High Initial Costs: The upfront investment for automation technology, including software and training, can be substantial. This initial financial commitment can deter organizations from pursuing automation.

- Complexity of Implementation: Automation requires careful planning and execution. The complexity involved in reengineering workflows can lead to delays and unexpected challenges, putting additional strain on resources.

Employee Resistance and Its Management

Resistance from employees is a common challenge that organizations face when implementing automation. Many employees may fear job loss or feel uncertain about adapting to new technologies. Addressing these concerns is essential for fostering a positive environment conducive to change.

- Change Management Strategies: Implementing effective change management strategies can help ease the transition. This may include regular communication, training sessions, and involving employees in the automation process.

- Demonstrating Benefits: Highlighting the advantages of automation, such as reduced workloads and increased efficiency, can help alleviate fears. When employees understand the positive impacts, they are more likely to embrace the changes.

- Providing Support: Continuous support and training during and after implementation ensures employees feel confident in using the new systems, which can significantly reduce resistance.

Data Security Concerns and Mitigation Strategies

As organizations migrate to automated claim processing systems, data security becomes a paramount concern. Automated processes often involve sensitive personal and financial information, making them attractive targets for cyber threats.

- Identifying Vulnerabilities: Organizations must conduct thorough assessments to identify potential vulnerabilities within their automated systems. This step is crucial in determining the necessary security measures to implement.

- Implementing Encryption: Utilizing strong encryption protocols for data in transit and at rest can protect sensitive information from unauthorized access and breaches.

- Regular Security Audits: Conducting regular security audits and vulnerability assessments helps organizations stay ahead of potential threats. This proactive approach can mitigate risks associated with data breaches.

Best Practices for Successful Claim Processing Automation

Implementing claim processing automation can significantly enhance efficiency, reduce errors, and improve customer satisfaction. However, a structured approach is essential to ensure a successful transition from manual to automated processes. Organizations must carefully plan their automation journey to maximize benefits while addressing potential challenges.A well-defined plan provides a roadmap for successful implementation. Key steps to facilitate a smooth transition include assessing current processes, defining clear objectives, and identifying the right tools to meet specific needs.

Understanding these steps is crucial for organizations to navigate the complexities of automation effectively.

Structured Plan for Implementation

Creating a comprehensive implementation plan involves several critical components. This plan should Artikel the specific objectives of automation, the processes to be automated, and the expected outcomes. Here are the key steps to consider:

- Conduct a thorough assessment of existing claim processing workflows to identify bottlenecks and inefficiencies.

- Define clear objectives for automation, such as reducing processing time, minimizing errors, or improving customer experience.

- Engage stakeholders across departments to gather insights and ensure buy-in for the automation initiative.

- Develop a timeline with milestones to track progress and ensure accountability throughout the implementation process.

Smooth Transition from Manual to Automated Processes

Transitioning to automated processes requires careful planning and execution. Organizations must manage the change effectively to ensure a seamless experience for both employees and customers. Here are essential practices to consider during the transition:

- Train employees on the new systems and processes to minimize resistance and enhance adoption.

- Implement phased rollouts to gradually introduce automation, allowing for adjustments based on feedback and performance.

- Monitor system performance and user engagement closely to identify areas for improvement and ensure the automation is delivering expected results.

- Encourage open communication among team members to share experiences and address challenges encountered during the transition.

Selecting the Right Software or Tools

Choosing appropriate software or tools is a critical factor in the success of claim processing automation. The right technology should align with organizational goals and enhance workflow efficiency. Here are considerations for selecting the most suitable tools:

- Evaluate software based on scalability to ensure it can accommodate future growth and changes in processing demands.

- Consider integration capabilities with existing systems to facilitate data sharing and streamline processes.

- Assess user-friendliness to minimize training time and enhance user adoption rates among employees.

- Review vendor reputation and customer support options to ensure reliable assistance throughout the implementation process.

“Selecting the right tools is not just about technology; it’s about enhancing human capabilities and improving processes.”

By following these best practices, organizations can navigate the complexities of claim processing automation more effectively and achieve desired outcomes that enhance both operational efficiency and customer satisfaction.

Future Trends in Claim Processing Automation

The landscape of claim processing automation is undergoing rapid evolution, driven by advancements in technology and shifting market demands. As organizations seek to enhance efficiency and accuracy, several emerging trends are poised to redefine how claims are processed in the insurance and healthcare sectors. One notable trend is the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies.

These innovations enable systems to analyze vast amounts of data quickly, identifying patterns and anomalies that can streamline claim approvals. Furthermore, natural language processing (NLP) is being integrated to enhance communication in claims assessment, allowing automated systems to interpret and respond to human language with greater precision.

Emerging Technologies in Claim Processing

The integration of new technologies is essential for future claim processing automation. Key technologies that are likely to shape this future include:

- Blockchain: This technology offers a secure and transparent method for tracking claims, thereby reducing fraud and enhancing trust among stakeholders.

- Robotic Process Automation (RPA): RPA can automate repetitive tasks, such as data entry and document processing, significantly reducing human error and operational costs.

- Cloud Computing: Cloud services facilitate data storage and processing, allowing for flexible and scalable claim management solutions.

- Telematics: In the insurance domain, telematics can provide real-time data on driving behavior, which can be used to automate claims related to vehicle incidents.

Shifts in Regulatory Requirements

As automation technology advances, regulatory frameworks are also expected to evolve. Stakeholders must stay abreast of the changing landscape to ensure compliance. Potential shifts may include:

- Data Privacy Regulations: As more data is collected through automated systems, regulatory scrutiny related to data protection will increase, necessitating stringent compliance measures.

- Standardization of Automated Processes: Regulators may introduce standardized protocols for automated claim processing to ensure fair treatment of all claimants.

- Increased Liability for Errors: As automation capabilities grow, there may be a shift towards holding organizations accountable for errors made by automated systems.

Predictions for Automation Evolution in Insurance and Healthcare

Looking ahead, the evolution of automation in the insurance and healthcare industries is likely to manifest in several ways. For example, we might see a more integrated approach where insurers and healthcare providers collaborate on shared platforms, enhancing the overall efficiency of claim processing. Another prediction includes the rise of chatbots and virtual assistants, which will play a key role in customer service.

These AI-driven tools will provide claimants with real-time updates and guidance throughout the claims process. Additionally, predictive analytics will become critical in assessing risk, enabling insurers to tailor policies more effectively based on data-driven insights.As these trends unfold, organizations that embrace innovation and adapt to regulatory changes will be well-positioned to lead in a competitive landscape. The future of claim processing automation holds great promise for efficiency, accuracy, and enhanced customer experiences.

Case Studies of Successful Claim Processing Automation

In the world of insurance and claims management, automation has proven to be a game-changer for many organizations. By adopting advanced technologies, several companies have streamlined their claim processing workflows, resulting in improved efficiency and customer satisfaction. This section explores real-world examples of organizations that have successfully implemented claim processing automation, the strategies they employed, and the outcomes they achieved.

Case Study: ABC Insurance Group

ABC Insurance Group, a leading provider in the health insurance sector, implemented automation in their claims processing to reduce turnaround times and enhance accuracy. They adopted machine learning algorithms to analyze claim submissions and identify discrepancies before they entered the system. Key strategies included:

- Integration of AI-driven software to predict claim outcomes based on historical data.

- Implementation of real-time monitoring systems to track the status of claims.

- Training staff on new technologies to ensure a smooth transition and adoption.

The outcome was significant: ABC Insurance Group reported a 30% reduction in claim processing time and a 25% increase in customer satisfaction ratings.

Case Study: XYZ Auto Insurance

XYZ Auto Insurance focused on automating their claims handling by implementing a comprehensive digital platform. This platform incorporated robotic process automation (RPA) to handle repetitive tasks, such as data entry and document verification. Their strategies included:

- Utilization of cloud-based software for improved accessibility and data management.

- Establishing a multi-channel communication approach for customers to submit claims via mobile apps and online portals.

- Regular feedback loops with customers to refine the claims process.

As a result, XYZ Auto Insurance achieved a 40% decrease in administrative costs and improved claim accuracy by over 15%.

Case Study: DEF Property Solutions

DEF Property Solutions, specializing in property insurance, tackled the inefficiencies in their claims process by adopting an end-to-end automation strategy. They focused on using natural language processing (NLP) to analyze customer communications and automatically categorize claims based on urgency and type. Their approach involved:

- Investing in advanced NLP tools to better understand customer inquiries.

- Creating a centralized claims database to streamline information retrieval.

- Developing a proactive communication strategy to keep claimants informed throughout the process.

The deployment led to a notable 50% increase in claims processed per employee, showcasing the power of technology in enhancing productivity.

“Automation is not just about reducing costs; it’s about enhancing the customer experience.” – DEF Property Solutions’ CEO

These case studies highlight that successful claim processing automation is not solely about technology. It requires a strategic blend of people, processes, and tools to achieve the desired outcomes. Organizations looking to implement such changes can learn valuable lessons from these examples, emphasizing the importance of integration, training, and customer engagement throughout the automation journey.

Measurement and Evaluation of Automation Success

Measuring the effectiveness of automated claim processing systems is crucial to ensure they are functioning optimally and delivering the expected benefits. This evaluation not only informs management about the system’s performance but also highlights areas for improvement. By setting clear objectives and performance metrics, organizations can gauge the impact of automation on their claims processing efficiency.Key performance indicators (KPIs) are essential metrics that provide insight into the effectiveness of automation.

Selecting the right KPIs allows organizations to monitor performance closely and adjust strategies as needed. Here are some critical KPIs to track post-automation:

Key Performance Indicators (KPIs) for Claim Processing Automation

Monitoring KPIs assists organizations in identifying strengths and weaknesses in their automated processes. The following KPIs are vital for evaluating the success of automated claim processing systems:

- Claims Processing Time: This measures the average time taken to process a claim from submission to resolution. Reducing this time indicates improved efficiency.

- First Pass Resolution Rate: This KPI reflects the percentage of claims that are resolved on the first attempt without further inquiries. A higher rate signifies effectiveness in initial evaluations.

- Cost per Claim: This metric tracks the overall cost associated with processing each claim. Automation should ideally reduce this cost over time.

- Customer Satisfaction Score: Feedback from customers regarding their experience with the claims process can highlight the impact of automation on service quality.

- Error Rate: Monitoring the frequency of errors in processed claims provides insight into the accuracy of the automated system and indicates areas needing adjustment.

Continuous evaluation and improvement of automated processes are essential to maintain their effectiveness and adapt to evolving business needs. Conducting regular assessments can reveal performance gaps and inform strategic decisions. Employing the following methods can facilitate ongoing evaluation and enhancement of the automation process:

Methods for Ongoing Evaluation and Improvement

Establishing a framework for continual assessment of automated systems helps organizations react to changing circumstances and technology advancements. Key methods include:

- Regular Performance Reviews: Scheduling periodic reviews of KPIs fosters a culture of accountability and allows teams to identify trends and areas for improvement.

- Feedback Loops: Actively soliciting feedback from employees and customers creates opportunities for real-time adjustments and enhancements.

- Benchmarking Against Industry Standards: Comparing automated processes to industry best practices can provide insights into potential improvements and innovations.

- Implementation of Agile Methodologies: Adopting agile practices enables organizations to make rapid adjustments in response to performance data and emerging challenges.

- Utilization of Advanced Analytics: Leveraging data analytics tools can provide deeper insights into process performance, allowing for data-driven decision-making and strategic improvements.

Incorporating these measurement and evaluation techniques ensures that automated claim processing systems remain agile, responsive, and aligned with organizational goals, ultimately leading to sustained operational success.

Final Summary

In summary, the journey through Claim Processing Automation reveals a landscape rich with potential for efficiency and cost-effectiveness. As organizations continue to embrace these automated solutions, they can expect to see not only improved accuracy in processing claims but also enhanced customer experiences. By understanding the challenges and best practices, businesses are better positioned to thrive in a fast-evolving environment that demands agility and innovation.

Common Queries

What is Claim Processing Automation?

Claim Processing Automation refers to the use of technology to streamline and automate the handling of claims, reducing manual effort and errors.

What industries benefit most from Claim Processing Automation?

Industries such as insurance, healthcare, and finance benefit significantly from automating claim processes, leading to improved efficiency and accuracy.

How does AI contribute to Claim Processing Automation?

AI enhances claim processing by enabling predictive analytics, improving decision-making, and automating routine tasks through machine learning.

What are common challenges in implementing automation?

Common challenges include resistance from employees, integration with existing systems, and concerns regarding data security.

How can organizations measure the success of automation?

Success can be measured using key performance indicators (KPIs) such as processing time, error rates, and customer satisfaction levels.